B Corp vs. Benefit Corporation: A Strategic Choice

Editor's Note: This post was originally published on January 28, 2025. As I migrate my work to this new platform, I've updated it to better reflect my current frameworks and sharpened my thinking from the original piece. The core ideas remain the same.)

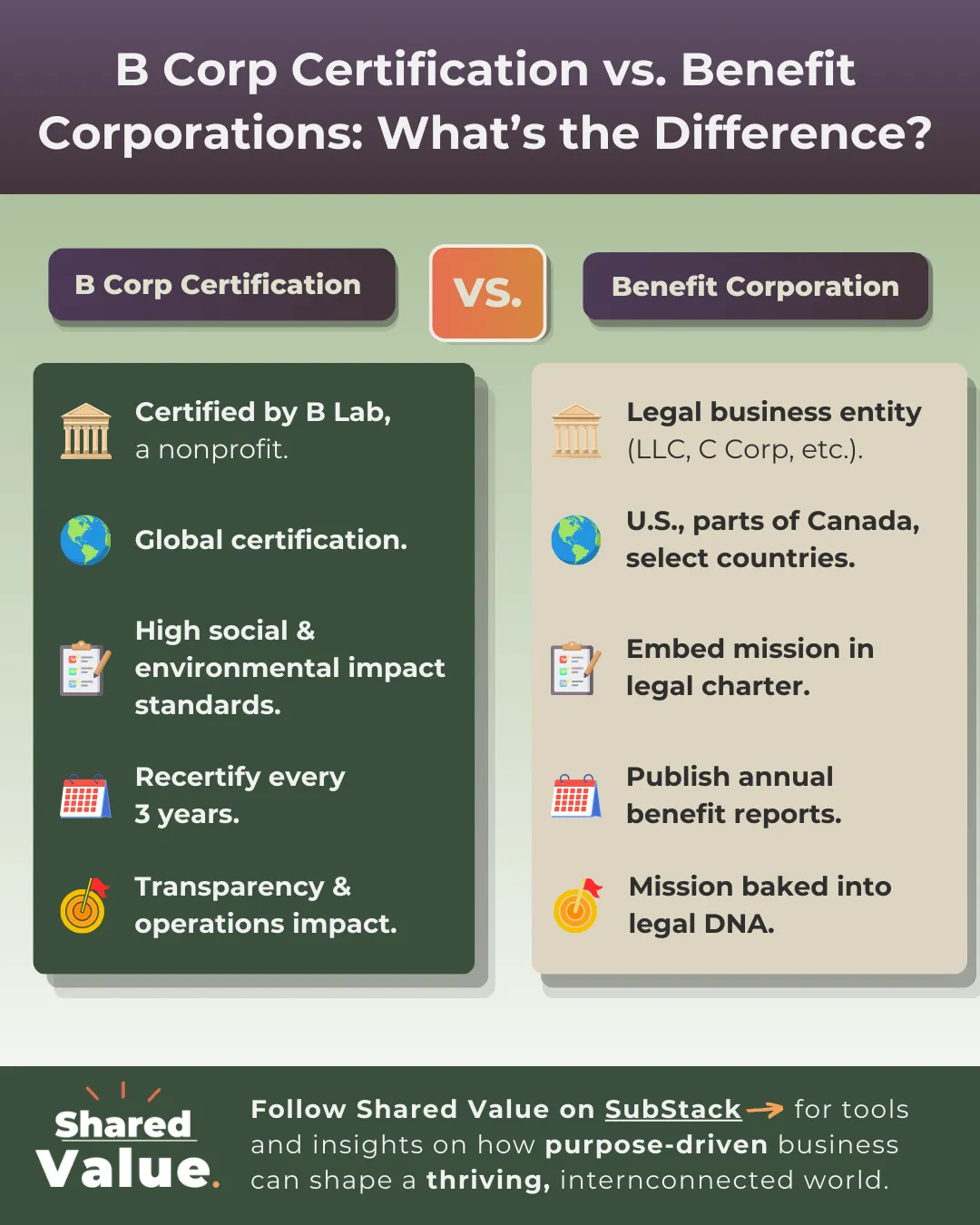

In purpose-driven business, “B Corp” and “Benefit Corporation” often get used interchangeably. They shouldn’t.

Both signal a commitment beyond profit. But one’s a third-party certification. The other’s a legal structure.

And that distinction isn’t just semantics — it’s strategy. The path you choose shapes how your business operates, attracts capital, and protects its mission for the long haul.

Certification vs. Legal Structure

The simplest way to think about it: B Corp is credibility. Benefit Corporation is legal commitment.

Certified B Corp

- Certified by: B Lab, a nonprofit.

- Requirements: Meet high standards of social and environmental impact; recertify every three years.

- Focus: Transparency and operational performance.

Benefit Corporation

- Type: A legal business entity (LLC, C Corp, etc.) available in the U.S., parts of Canada, and select other jurisdictions.

- Requirements: Embed mission into the charter; publish annual benefit reports.

- Focus: Mission baked into the legal DNA.

They’re distinct, but complementary. Many leading companies do both — pairing the credibility of certification with the legal teeth of Benefit Corporation status to lock in their mission.

The Business Case Is Clear

Embedding purpose into your structure isn’t just a values play anymore. It’s a competitive edge.

- Resilience: B Corps are 63% more likely to survive economic downturns than non-B Corps.

- Investor demand: ESG assets are projected to surpass $50 trillion by 2025, with investors seeking accountability frameworks like these.

- Consumer expectations: Edelman’s 2024 Trust Barometer shows consumers increasingly reward businesses that take clear social and political stances.

The companies wiring purpose into their operations are the ones built to thrive.

Which Path Fits You?

It depends on your stage and goals:

- Startups & smaller companies: Certification is often the smart first step. It shows commitment, sets benchmarks, and doesn’t force immediate legal restructuring.

- Established enterprises or companies raising capital: Benefit Corporation status offers long-term mission protection that survives leadership changes or acquisitions — giving investors and stakeholders confidence the purpose will hold.

The Bottom Line

These frameworks are tools. They give your mission structural integrity — so it doesn’t fade into a vibe when pressure hits.

This is core to my work: helping founders and leaders choose and implement the right governance frameworks to protect mission, attract aligned capital, and build resilient, high-impact businesses.